GASB Statement No. 101, Compensated Absences

In June 2022, the Governmental Accounting Standards Board (GASB) issued GASB Statement No. 101, Compensated Absences (GASBS 101 or Statement). The Statement updates the accounting and financial reporting requirements for compensated absences and associated salary-related payments to better align the recognition and measurement guidance under a unified model which results in a liability for compensated absences that more appropriately reflects when a government incurs an obligation. Because this model can be applied to any type of compensated absences, the model will eliminate comparability issues between governments that may offer different types of leave.

BACKGROUND

Nearly every government offers compensated absences benefits, such as vacation leave, sick leave, paid time off (PTO) and holidays. Prior to GASBS 101, the most recent standard addressing accounting for compensated absences was GASBS 16, Accounting for Compensated Absences, issued in 1992. In 2018, the GASB approved a pre-agenda research activity to gather information regarding the effectiveness of GASBS 16 and to determine whether improvements were needed. The pre-agenda research found inconsistencies with the application of GASBS 16 and with the conceptual framework that was developed subsequent to GASBS 16. These results led the way to further outreach by the GASB with stakeholders which resulted in the publication of an exposure draft, Compensated Absences, in February 2021 and eventually GASBS 101.

The Statement supersedes GASBS 16 as well as other earlier compensated absences guidance issued in various implementation guides.

ACCOUNTING RECOGNITION

GASBS 101 defines a compensated absence as leave for which employees may receive one or more (a) cash payments when the leave is used for time off; (b) other cash payments, such as payment for unused leave upon termination of employment; or (c) noncash settlements, such as conversion to defined benefit postemployment benefits. Payment or settlement may occur during employment or upon termination from employment.

Leave That Has Not Been Used

Governments are required to recognize liabilities for leave that has not been used if (a) the leave is attributable to services already rendered; (b) the leave accumulates; and (c) the leave is more likely than not to be used for time off or otherwise paid in cash or settled through noncash means. The GASB defines leave attributable to services already rendered as leave for which an employer has performed the services required to earn the leave.

When evaluating whether leave is more likely than not to be used for time off or otherwise paid in cash or settled through noncash means, a government should consider (a) the government’s employment policies; (b) whether leave that has been earned is, or will become, eligible for use or payment in the future; (c) historical information about the use, payment or forfeiture of compensated absences; and (d) information that would indicate historical information may not be representative of future trends or patterns.

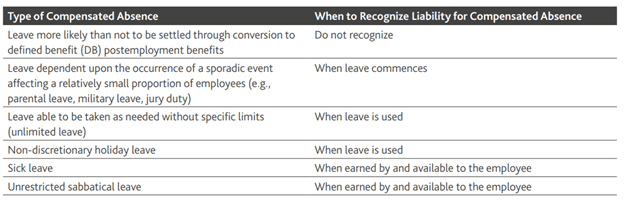

The following table displays common types of compensated absences for leave that has not been used and when (or whether) to recognize a liability for the compensated absences:

The leave liability should be computed using an employee’s pay rate as of the date of the financial statements, unless some or all of the leave is more likely than not to be paid at a different rate, the leave is not attributable to a specific employee (such as donated leave in a PTO pool), or some or all of the leave is more likely than not to be settled through noncash means other than conversion to DB postemployment benefits.

The following examples are provided to illustrate how a government would recognize a compensated absence for different types of leave that has not been used:

Example 1 – A June 30 fiscal year-end government has an employee who has begun a four-month paid parental leave of absence. The employee went on leave effective May 15, with a return date of Sept. 16. The government will recognize a liability as of June 30 for the remaining amount of paid leave (2 ½ months).

Example 2 – A government recently enacted an unlimited leave policy for all employees with over three years of service. The government would not recognize a liability until the leave had been used, at which point the government has an obligation to pay or settle through non-cash means (see section below for “leave that has been used.”)

Example 3 – A Dec. 31 year-end government recognizes New Year’s Day (Jan. 1) as a paid holiday. The government would not recognize a liability as of Dec. 31 since the leave has not yet been used.

Example 4 – A Sept. 30 year-end government offers all employees 8 hours of paid time off per bi-weekly pay period worked. Unused leave accrues and can be used in future periods at the employee’s discretion. If the government has determined the probability that the leave is more likely than not to be used for time off, a government should recognize a liability as of Sept. 30 for all unused leave attributable to services already rendered.

Leave That Has Been Used

For leave that has been used but not yet paid in cash or settled through non-cash means, a related liability should be measured at the amount of the cash payment or non-cash settlement to be made for the use of the leave.

Salary-Related Payments

Salary-related payments are obligations related to providing leave in exchange for services rendered. The compensated absences liability should include salary-related payments directly and incrementally associated with the leave. A payment is directly associated if the amount depends on the amount of salary to be paid. A payment is incrementally associated if the payment is in addition to the payment for the salary. Liabilities associated with salary-related payments should be measured using the rates in effect as of the date of the financial statements.

Relationship to Postemployment Benefits

Leave that has not been used and that is more likely than not to be paid to an employee by distribution to an individual postemployment benefits account should be included in the compensated absences liability if it meets the compensated absences recognition criteria.

A government should not include in the compensated absences liability the projected effects on their defined benefit postemployment benefits liability resulting from payment of compensated absences.

FINANCIAL REPORTING

The Statement requires liabilities for compensated absences to be recognized in financial statements prepared using the economic resources measurement focus equal to the amount of leave that has not yet been used and leave that has been used but not yet paid or settled. Applicable salary-related payments should be included in the measurement of those liabilities.

The Statement did not change how governments should report compensated absences in financial statements prepared using the current financial resources measurement focus (i.e., the governmental funds).

The Statement amends previous requirements found in GASBS 34 related to disclosure of gross increases and decreases in compensated absences along with other long-term liabilities to now provide governments the option to present either separate increases and decreases or a net increase or a net decrease in compensated absences. A government that presents a net increase or a net decrease should indicate that it is a net amount. Additionally, governments are no longer required to present which governmental fund typically liquidates compensated absences.

EFFECTIVE DATE

The requirements of GASBS 101 are effective for fiscal years beginning after Dec. 15, 2023, and all reporting periods thereafter. Earlier application is encouraged.

Written by Sam Thompson. Copyright © 2022 BDO USA, LLP. All rights reserved. www.bdo.com