Is Your Organization Audit Ready?

Whether you are facing an audit for the first time or you have been audited for years, making sure that your nonprofit organization is ready might feel overwhelming. Here are a few tips to help you prepare for a first, or just the next, audit.

First, what is an audit (and what is it not)?

The purpose of an audit, as defined by the American Institute of Certified Public Accountants (AICPA), is “to provide financial statement users with an opinion by the auditor on whether the financial statements are presented fairly, in all material respects, in accordance with the applicable financial reporting framework. An auditor’s opinion enhances the degree of confidence that intended users can place on the financial statements.” In the nonprofit industry, the stakeholders are donors, funders and regulators, such as a state charities bureau that approved your organization to solicit funds from donors in that state.

In layman’s terms, an audit provides reasonable assurance—not absolute assurance—that the financial statements are correct (not materially misstated) within a defined threshold. The AICPA provides a set of standards that all audit firms are required to follow to achieve the appropriate level of assurance to issue the opinion. But an audit is not just a generic set of checklists. The auditor creates a tailored set of procedures based on a gained understanding of the organization designed to mitigate the risk of material misstatements within financial statements.

What might cause you to need an audit for the first time?

New funding sources like debt, grants or growth that triggers regulatory requirements in certain states may require an organization to submit financial statements that are audited in accordance with generally accepted accounting principles. Therefore, before any new grant or debt is signed, make sure someone in your accounting department is reviewing the requirements thoroughly. You don’t want to be surprised with a first-time audit!

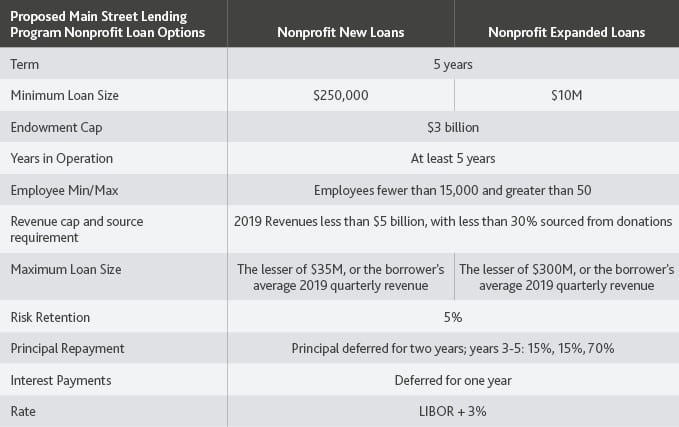

During the COVID-19 pandemic, your organization may have taken on new debt that requires an audit. In addition, you may have received funding from the Coronavirus Aid, Relief, and Economic Security (CARES) Act that may require an audit under the Office of Management and Budget’s Uniform Administrative Requirements, Cost Principles, and Audit Requirements for Federal Awards (Uniform Guidance). To understand if the funding you received is subject to the Uniform Guidance, you should review the Assistance Listing available at beta.sam.gov, contact the funding source and subscribe to our blog for more information.

So, how can you ensure your organization is prepared for its first audit?

Follow these 10 steps:

1. Gather all your organizational documents and significant contracts into one central location (preferably electronically), including:

- Articles of Incorporation

- Bylaws

- Corporate Operating Agreement

- Internal Revenue Service (IRS) 501(c)(3) determination letter

- IRS Form 1023

- Applicable state tax determination letters

- All significant contracts (customer/grants/leases/vendor/pledge agreements)

- Board minutes from the year(s) under audit

- Commercial insurance policies

- Trust agreements (annuities, life insurance policies, split-interest agreements, etc.)

- All pension and post-retirement plan documents

- Legal titles for real property owned

- Corporate organizational chart

- Staff organizational chart

- Organization’s policies and procedures manuals

- Other organizational documents

2. Document your key financial statement processes and policies. During the documentation process consider if your organization has proper internal controls and if the performance of those controls is adequately documented. Remember to consider your controls and policies over information technology systems that support your accounting records.

- For guidance around internal controls, certain resources are available from the Committee of Sponsoring Organizations of the Treadway Commission at www.coso.org or the Green Book published by the U.S. Government Accountability Office at www.gao.gov.

3. Compile a list of related parties, including related entities, and clearly document the relationship with each related party as well as a listing of any related agreements between the parties.

- Consider consulting with your legal counsel (either internal or external) to ensure all legal relationships are properly documented.

4. Review your accounting records and ensure that reconciliations are available for any balance sheet account as necessary to reconcile sub-ledger data (or any data maintained outside of the ledger) to the trial balance.

5. Ensure that transactional data from the period under audit (e.g., proof of expenses, sales, contributions or payroll records) is organized and available for testing, as requested.

6. Ensure that a full schedule of all property and equipment, and related depreciation and amortization, is available.

7. Obtain sample audited financial statements of similar organizations. Review the financial statements to gain an understanding of what data to have available to produce the required footnote disclosures. Sample financial statements can be found on many peer nonprofits’ websites, www.Guidestar.org or on the Federal Audit Clearinghouse website (if the nonprofit was required to have an audit performed in accordance with Uniform Guidance).

Once you’ve hired your audit firm of choice (and before any recurring engagement) you should:

8. Facilitate a meeting with the audit team and those individuals you have designated as your financial governance committee (e.g., audit committee, finance committee, board of directors, etc.) to set expectations and discuss specific risks related to your organization.

9. Hold a meeting with the audit team and your management to discuss timing and specific items that you will need to prepare based on the tailored approach prepared by the auditor. Finalize the timeline of all deliverables to ensure that your financial statements will be issued by the date required. Once you have received the specific list of items to be prepared by the organization, hold an internal meeting to assign responsibility for each task and consider how the information will be prepared and reviewed prior to delivery to the auditor.

10. If your organization has inventory, ensure that you invite the audit team to the year-end count or the next scheduled perpetual count.

With careful consideration of these steps and allowing adequate time for your team to pull and organize this information, even a first-year audit should run smoothly.

Recurring Audits

In addition to Tips 8-10, consider:

1. The relationship with your audit firm shouldn’t be confined to just the yearly audit. Keep in touch throughout the year to discuss changes in your strategies, funding, processes, etc. so your auditors can advise if there are any potential accounting or compliance issues you should consider. A nonprofit’s financial statements are often public documents, so checking in on how new events and transactions may impact your audit and financial statement presentation can help mitigate unwanted surprises. Talk to your auditors about any changes in accounting controls or any new funding streams that might impact compliance requirements.

2. Stay informed about any changes to legislation, accounting pronouncements or other compliance updates that will impact your organization’s financial statement presentation or compliance rules. While it is often assumed that it is only the auditor’s job to keep up with changes, management should have a working knowledge of requirements. Keeping up with any changes will also ensure that the accounting system and records are set up to produce the required information the auditors will need to audit your organization’s adoption of new standards.

3. Stay organized! Create a logical electronic filing system to ensure you can easily locate the information that has been requested and any materials your team has prepared. Then, keep the files until at least the following year for reference.

Remote Audits

The COVID-19 pandemic required many organizations to allow office employees to work remotely and many organizations have chosen not to bring the full team back into the office at this time. Thus, it’s likely that a portion, if not all, of your audit in the coming months will be handled remotely. The keys to managing a successful audit under COVID-19 restrictions are communication and flexibility. Here are some additional considerations as you prepare for a remote audit:

1. Review what, if any, changes have occurred in the internal control processes to accommodate remote working. Are there changes in the check writing or depositing process? Are there changes to approval controls? Discuss these changes with your auditor ahead of the scheduled audit.

2. Discuss with your auditor what file repository system will be utilized for the remote sharing of data from your organization to your auditors in a secure manner. Ensure that the filing system will meet the cybersecurity requirements of your organization.

3. Discuss the timeline with your auditor well in advance this year. Consider if additional time may be required for your team to transfer physical files into electronic copies.

4. Consider using video technology to allow for the auditor to observe processes through the digital environment and allow for “in-person” meetings and interviews throughout the audit. An auditor could potentially even use digital methods to conduct a physical inventory count observation.

5. Consider safety protocols that your organization and the auditor’s firm will require if in-person work or meetings are deemed necessary. Ensure that each team understands the legal and organizational requirements for protective equipment and social distancing protocols.

The word “audit” can often be a source of fear and dread. However, following these tips can help your nonprofit organization get audit ready. For well-prepared organizations, the audit process can be a helpful tool for assessing financial health rather than an exhaustive exercise in pulling data. Communicating with your auditors has always been important, but the challenges of the pandemic have made open collaboration and flexibility between nonprofits and their auditors more critical than ever.

This article was used with permission by BDO USA, LLP. Please click here to view the original article.